Touring is a major source of profits for today’s successful recording artists, and they spend considerable sums on venues and staging to bring music to their fans. But the list of things that can go wrong before and during a tour is almost endless.

That’s why artists, tour companies, and record labels purchase various forms of insurance to mitigate risk from postponements or cancelations. However, as we know from representing Grammy-winning artists in tour insurance disputes, losses to the tune of millions of dollars can result if proper insurance is not obtained or coverage disputes are not handled appropriately. One such risk, and the focus of this article, is artist illness.

Major artists’ tours are often long, spanning many months and continents. Given the length of time and amount of travel involved, artists can become sick or injured over the course of a tour, potentially leading to cancellations of both individual shows and entire tour legs. When this happens, the policyholder will look to his or her insurer for coverage, and the insurer will look at both the terms of the policy and what was disclosed about the artist when the policyholder applied for the policy.

Even when a policyholder and insurer agree on the cause of cancellation—such as when the artist suffers a back injury or laryngitis—they may nonetheless disagree about whether that cause is covered. The argument could be as fundamental as whether the policy applies at all, such as how insurers often dispute whether a loss was caused by a covered “peril” within the scope of the policy’s definitions. When illness is the cause, the contents of the policy application also often come into play. Insurers typically require policyholders to disclose known risks when applying for insurance, and will deny or dispute coverage for a loss that they argue was based on information improperly withheld. For example, insurers might focus on the artist’s medical forms provided through the underwriting process in an attempt to link the reason for the cancellation with a pre-existing condition that was not previously disclosed. This process can be invasive, time consuming, and costly.

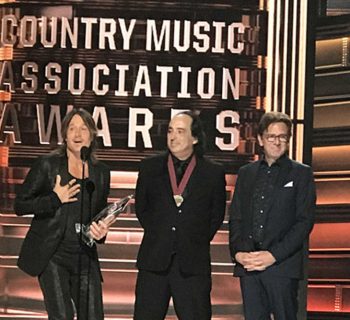

This was the case when Nickelback was forced to cancel part of their 2015 No Fixed Address tour due to polyps discovered on their lead singer’s throat. The band’s insurers denied coverage for the costs associated with cancellation, asserting that Nickelback had submitted false medical statements. The insurers also filed a lawsuit to rescind coverage based on the alleged false submission.

However, whether something was disclosed is not the end of the story—under most states’ law the insurer must have relied on the omission of a material fact to escape coverage based on a failure to disclose. See, e.g., Royal Indem. Co. v. Kaiser Aluminum & Chem. Corp., 516 F.2d 1067, 1070 (9th Cir. 1975) (holding that under California law, an insurer must prove reasonable reliance on a misrepresentation of material fact to rescind an insurance contract); Am. States Inc. Co. v. Ehrlich, 701 P.2d 676, 680 (Kan. 1985) (requiring the policyholder to have made an untrue statement of fact and the insurer to have justifiably relied on the misrepresentation for coverage to be barred).

In the Nickelback case, during the course of coverage litigation the insurers’ lead underwriter admitted that the insurers did not actually rely upon any of the medical information submitted before issuing the policy and setting its premiums. Instead, the insurers had a business practice of not relying upon such information in order to stay competitive with other insurers in the tour insurance market. The case settled shortly before trial. This goes to show it is important for a policyholder to understand the role that medical information actually played in the underwriting process, and that insurer assertions that might seem to be accurate on their face must be carefully scrutinized and tested before a policyholder surrenders valuable coverage.

In other instances, the policyholder and insurer might disagree on the cause of cancellation. In that case, the first issue of dispute typically will be what caused the tour to be canceled, because policies only apply to designated causes of loss. Such a dispute could again center on the coverage grant of the policy (such as whether loss was caused by a “peril”), or the insurers may argue that cancellation was caused by something excluded under the policy.

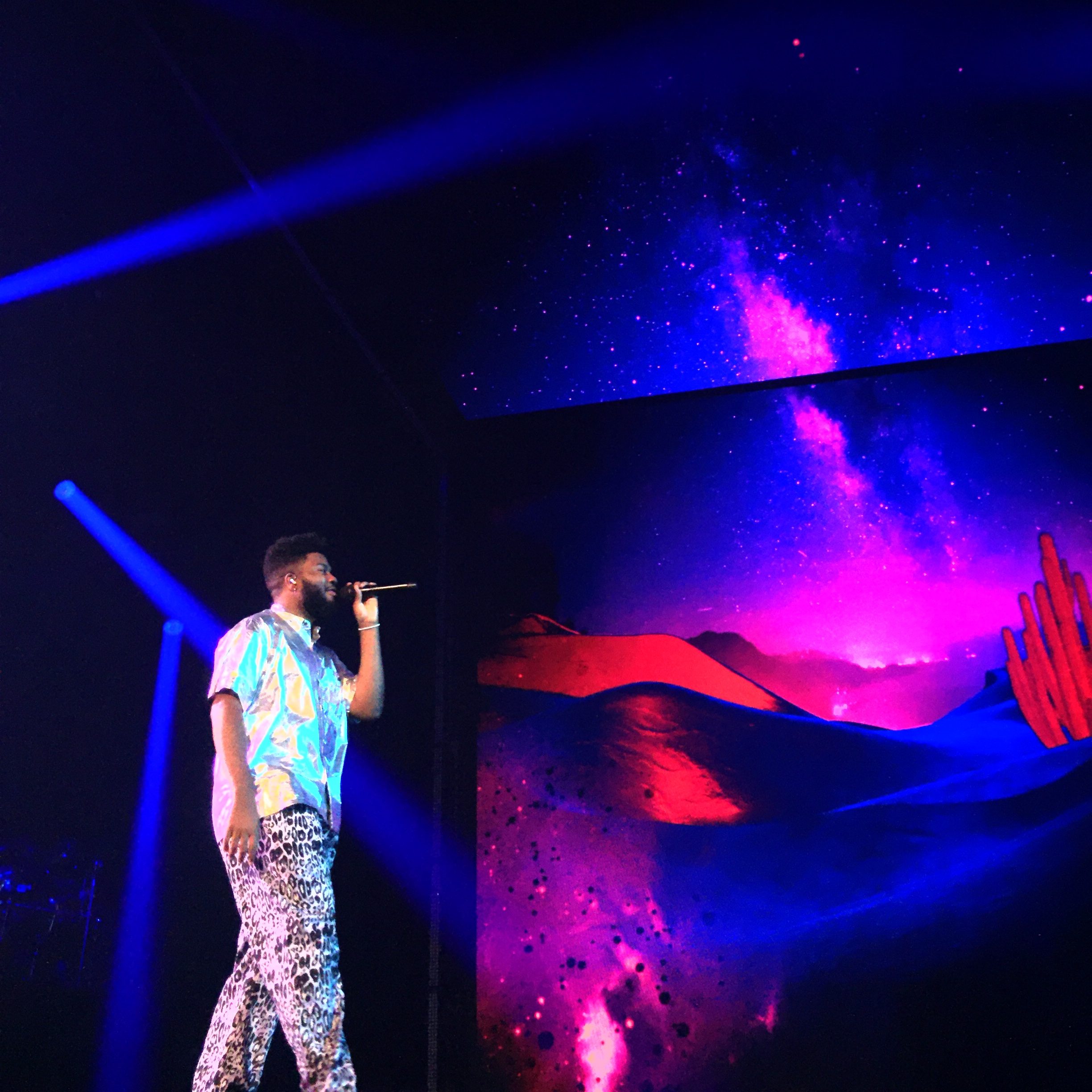

For example, Kanye West’s cancelation of his 2016 Saint Pablo tour resulted in multiple coverage claims, with West claiming he suffered a “debilitating medical condition” and his insurers insinuating the cancelation was due at least in part to mental health issues—which were excluded, as they often are, under the policy. The insurers’ arguments created a caustic media environment for West and raise an important question: how far can insurers go in delving into an artist’s psychiatric history merely because they premise their coverage denial on alleged mental health issues? It turns out the answer is not very far.

When an insurer relies on an exclusion to deny coverage, a policyholder must consider how the facts align with the exclusion and non-insurance specific law that may impact the answer to that question. Policyholders also should remember that insurers—rather than policyholders—bear the burden to establish that an exclusion unambiguously applies.

In Kanye West’s case, the coverage dispute was filed in federal court in California, a state with a robust psychotherapist–patient privilege that shields mental health records from discovery. See CAL. EVID. CODE § 1014 (West). This privilege applies whenever a patient has engaged in a confidential communication seeking diagnosis or advice in the context of a psychotherapist–patient relationship. Critically, this privilege is very broad, controlled by the patient, and applies both to discovery and admissibility of mental health records. See San Diego Trolley, Inc. v. Superior Court, 87 Cal. App. 4th 1083, 1090–93 (2001), disapproved of on other grounds by Williams v. Superior Court, 3 Cal. 5th 531 (2017). Moreover, the privilege applies in both California state courts and California federal courts where federal jurisdiction is based in diversity and there are only state law claims (as is typical in insurance coverage actions). See 6–26 Moore’s Fed. Practice—Civil § 26.47[4]; Liew v. Breen, 640 F.2d 1046, 1049 (9th Cir. 1981) (“Questions of privilege in diversity actions are controlled by the governing state law.”).

Kanye West’s insurers would not have been able to overcome this privilege merely by raising the specter of mental health in their coverage denials. California law recognizes that a patient may rebut allegations related to mental illness without waiving the psychotherapist–patient privilege. See 27B CAL. JUR. 3D DISCOVERY AND DEPOSITIONS § 45. Furthermore, courts have explained that a patient does not waive the privilege unless he has “chosen to reveal” otherwise protected communications. See N.S. v. Superior Court, 2016 WL 7826623, at *710 (Cal. App. 1st Dist. 2016).

And, even if West’s case had been filed in a court outside of California, the result would likely have been the same. Nearly every state has some form of psychotherapist–patient privilege, and controlling Federal case law states that “confidential communications between a licensed psychotherapist and her patients in the course of diagnosis or treatment are protected from compelled disclosure under Rule 501 of the Federal Rules of Evidence.” Jaffee v. Redmond, 518 U.S. 1, 15 (1996) (footnote omitted).

Ultimately, West’s insurers settled, potentially due in part to their inability to meet their burden and escape coverage on this basis.

As these specific examples illustrate, the insurer playbook is familiar, and a policyholder educated on how to respond can avoid or overcome an initial denial and secure coverage. Also key is controlling the narrative through effective counsel who can assist in rapidly coordinating the actions of doctors, the media, and the artist to ensure a consistent message and head off—or push back on—pretextual coverage denials.

As the Ramones sang, “high-risk insurance, the time is right.” But that is not enough—a policyholder also must understand what that insurance covers and be prepared to fight for it.

By Jenna Hudson and Benjamin Massarsky – Gilbert LLP

JENNA HUDSON’S practice focuses on complex civil litigation and dispute resolution. She has represented policyholders in both federal and state trial courts with respect to a wide range of insurance coverage matters, including bodily injury and property damage, food-contamination, toxic tort, and directors and officers coverage. Jenna also advises post-bankruptcy trusts in the recovery of insurance proceeds.

BENJAMIN MASSARSKY is an associate at Gilbert LLP in Washington, DC. His practice focuses on representing policyholders in complex civil litigation and dispute resolution. He has represented policyholders in disputes over numerous types of coverage, including general commercial liability policies, political risk policies, and music tour non-appearance policies.

For further information, visit gilbertlegal.com.

This is an updated version of the Tip Jar article that appears in print in Music Connection’s July issue.